MRTA VS MLTA 2023

If you are taking a home loan and considering buying mortgage insurance, which products will you choose? – Mortgage Reducing Term Assurance ( MRTA ) or Mortgage Level Term Assurance (MLTA)

Some might say Mortgage Reducing Term Assurance ( MRTA ) as it’s cheaper. Or some will prefer Mortgage Level Term Assurance (MLTA), where the sum insured coverage is better and not reducing year by year.

Okay, regardless of which. Let’s sit down and understand both products before making any decision.

Mortgage Reducing Term Assurance ( MRTA )

Mortgage Reducing Term Assurance ( MRTA ) is insurance that covers the borrower in the event of death or total permanent disability (TPD).

When unforeseen circumstances happen, per se the death or TPD; under Mortgage Reducing Term Assurance ( MRTA), the insurance company will cover the outstanding loan.

Why Buy Mortgage Reducing Term Assurance ( MRTA)?

The bank encouraged everyone to buy Mortgage Reducing Term Assurance ( MRTA ). Typically people buy it because of the attractive Home Loan interest rates offer.

If you buy a Mortgage Reducing Term Assurance ( MRTA ), the bank will offer lower Home Loan interest rates in comparison to someone who doesn’t.

The fact is most banks have a flexible policy on this. It is not compulsory and only optional.

However, when people buy Mortgage Reducing Term Assurance ( MRTA ), they want the coverage and protection for their family.

Mortgage Reducing Term Assurance ( MRTA ) Premium

Mortgage Reducing Term Assurance ( MRTA ) cost depends on the insured age, coverage amount, home loan interest rate, gender, and years of coverage.

Also, paying methods like paying with cash or finance in the loan will increase the Mortgage Reducing Term Assurance ( MRTA ) insurance premium. Usually, when you finance MRTA with the home loan, the premium tends to be pricier.

The Misconception Of Mortgage Reducing Term Assurance ( MRTA )

Everyone will think MRTA will cover the latest home loan outstanding balance.

But, the truth is. The statement is only partially real.

I will explain it below.

Mortgage Reducing Term Assurance ( MRTA ) Example

Depending on how much you buy the Mortgage Reducing Term Assurance ( MRTA ), they have a table you can refer to. The coverage solely follows the table.

From the table here, you can understand a few things about Mortgage Reducing Term Assurance ( MRTA ).

On the table stated policy year and sum insured amount on the left, surrender Value and End of policy year on the right.

The example here shows a person with age 40, is taking a sum assured of RM300,000 for 30 years with 5% Home Loan interest rates. And the premium for the whole tenure is RM18,841. One month MRTA coverage is RM39.25. So, this is a decent coverage.

In the first year of the coverage, the sum insured is RM300,000. It means if anything happens to you in the first year, the MRTA policy have RM300,000 sum insured to pay your bank. If RM300,000 is the original loan amount, your loan will be fully settled by the insurance company.

If the original loan amount is RM400,000, and you bought MRTA coverage RM300,000. This will happens.

The MRTA policy will only cover RM300,000, and for another RM100,000, it will be top up by you or next of kin.

Mortgage Reducing Term Assurance ( MRTA ) Surrender Value

Surrender Value is when you no longer need the policy, and you surrender the insurance policy back to the insurance company.

Let said, you have pay RM18,841 premium, then you surrender it within the first year. So, you’ll get back RM14,262.00 from the premium you paid.

You will not get back the RM18,841, but the insurance company compensates you with RM14,262.00. The difference amount is RM4579. It’s going to be lesser from one year to another because the insurance company is giving you protection all over the years until you surrender the policy.

Second Example.

Let say, after ten years, you sell your property or refinance the home loan. What will happen to this MRTA policy?

Two things will happen, it depends on the insurance company.

a. The policy will be auto surrender, which means that the insurance policy no longer has any protection under it. And the insurance company will pay you back a specific amount based on surrender value. Based on this example, the Surrender Value is RM14,433.00.

Or

b. The MRTA will stand alone. It no longer attaches to the bank’s home loan. You will still receive insurance protection, and surrender of policy is not required. You can continue to use the MRTA until you surrender it or until the end of the policy year. However, not all insurance companies allow this. You’ll need to check with them.

Every MRTA policy will have a policy plan and table like the above picture. You should request it from your banker or insurance agent.

The Part Where No One Tell You About MRTA

I know not many banker or insurance agent will let you know about this. Either they themselves not aware of it or it too much trouble to explain.

Let me explain.

The above MRTA table is strictly based on the information below.

- age 40

- Female

- the sum assured of RM300,000

- Coverage 30 years

- 5% Home Loan interest rates

All the insurance companies will use the information above to quote you a premium amount.

But, what if the actual home loan interest rates exceed 5% over 30 years?

When this happens, the sum insured will not be sufficient to cover because the table is based on a maximum of 5% home loan interest rates.

So, if you have 30 coverage years, there is a chance that the home loan interest rates exceed the amount of 5%. When it does, your home loan outstanding balance will be higher than the sum insured. Hence, insufficient sum insured amount.

If you expected the sum insured to cover 100% of your outstanding balance when unforeseen circumstances happen, then that’s where you’re wrong.

It will cover, but might not be 100%. You might have to prepare for a top-up amount.

When I was working in a bank, I have encountered a few cases where a crying wife lost her husband. She walked into the bank, disappointed with the issue, and was so frustrated that the coverage isn’t 100%.

What can you do?

Well. Maybe for a start, you can ask a quote and make sure a reasonable home loan interest was key to your MRTA. But, I need to warn you that the higher the interest rates, the most expensive the premium will be.

You can also ask for advice from the banker or insurance agent for the reasonable home loan interest rates to key in.

Most importantly, you need to educate your spouse or your nominee about this and let them know that MRTA doesn’t necessarily give a 100% coverage.

Every year, when you receive your yearly home loan statement, you can always cross-check with the MRTA table here. To make sure whether you have sufficient coverage or not.

Next, we’re going to talk about MLTA.

Mortgage Level Term Assurance ( MLTA)

On the other hand, Mortgage Level Term Assurance (MLTA) is not part of the bank product.

Usually, Mortgage Level Term Assurance (MLTA) sells by a mortgage loan broker, insurance agent, or a banker to provide as an alternative to the Mortgage Reducing Term Assurance ( MRTA ).

In reality, Mortgage Level Term Assurance (MLTA) is a whole life insurance policy.

Many people repackage whole life insurance to become Mortgage Level Term Assurance (MLTA).

Whole Life Insurance is designed to provide lifetime coverage. Hence it usually has higher premium payments than term life.

Premium amount is typically fixed; it has a cash value, which functions as a savings component and may accumulate tax-deferred over time.

Over the years, Mortgage Level Term Assurance (MLTA) has evolved. Some people no longer sell Mortgage Level Term Assurance (MLTA) under a whole life insurance product.

They might mix things up with investment-linked insurance with some whole life insurance features.

Investment-linked insurance combines investment and protection, where your premiums will be divided for whole life insurance cover and investment in specific funds of your choice. You can choose the premium allocation ratio.

The thing about the investment-linked product is the cash value in the policy might increase or decrease over the years, depending on the performance fund.

Whole life insurance has a more steady cash value increase over the years, and by the end of tenure, the cash value in the whole life insurance policy will increase.

The benefit of Mortgage Level Term Assurance (MLTA)

Mortgage Level Term Assurance (MLTA) has a better protection value compare to MRTA.

Like MRTA, the primary MLTA coverage is for death and total permanent disability (TPD).

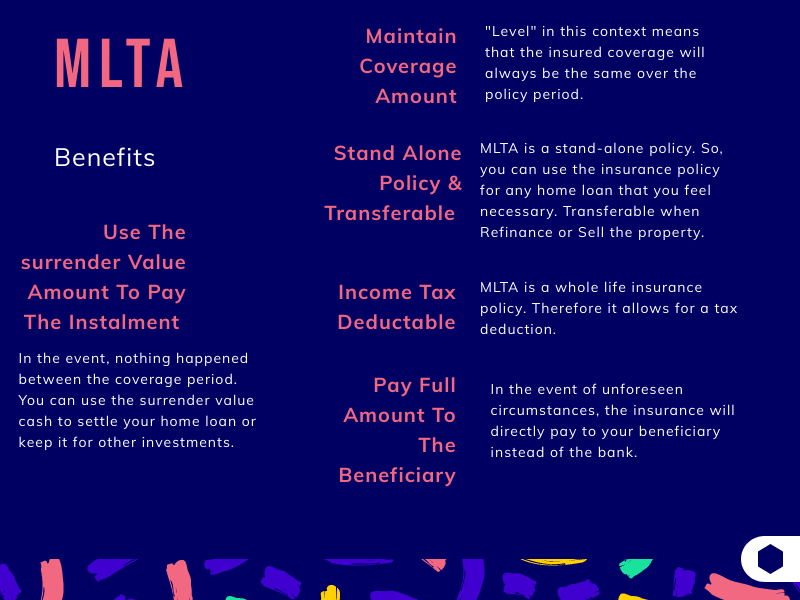

a. Maintain Coverage Amount

“Level” in this context means that the insured coverage will always be the same over the policy period.

Let say, if from the start you asked for coverage of RM300,000. Then, until the end of the policy tenure, it will still give you RM300,000 coverage, unlike its counterpart MRTA where the coverage ( sum insured amount) will be reducing over the years.

Based on an earlier example, in the 15th years, the MRTA gives coverage of RM212,552, but MLTA will still give you a coverage of RM300,000.

Or in the 30th year, MRTA coverage is RM18,812, but MLTA will always be RM300,000.

Therefore, you will not have any issue where the policy is insufficient to cover your home loan outstanding balance.

b. Stand Alone Policy & Transferable To Any Loan

Mortgage Level Term Assurance (MLTA) is a stand-alone policy. So, you can use the insurance policy for any home loan that you feel necessary.

For example, if you have five home loans. You can use it to cover any of the home loans; it doesn’t restrict you from applying for Bank A or Bank B.

You don’t need to transfer the policy from one bank to another when refinance or sell your property. You can easily use it for your next property.

c. Income Tax Deductable

Mortgage Level Term Assurance (MLTA) is a whole life insurance policy. Therefore it allows for a tax deduction.

d. Pay Full Amount To The Beneficiary

In the event of unforeseen circumstances, the insurance will directly pay to your beneficiary instead of the bank. Therefore, your beneficiary has full control of the money.

e. Use The Surrender Value Amount To Pay The Instalment

In the event, nothing happened between the coverage period. You can use the surrender value cash to settle your home loan or keep it for other investments. Unlike MRTA, you will not have this. Once the MRTA policy years end, you have nothing. But, with MLTA, you will have money sitting in the cash value.

Just think like this, a force saving with insurance protection for you.

Mortgage Level Term Assurance (MLTA) Surrender Value

Surrender value in MLTA under life insurance would have better value if you kept the policy over 15-25 years. If you enter the MLTA at an early age, you might get back all the premium you have paid. In other words, insurance is FREE to you while the protection is still ongoing.

However, MLTA under investment-linked products will be different compared to MLTA under whole life insurance products. For any investment-linked product, there is a portion of your premium will be used to invest.

Therefore, the surrender value is uncertain. It can be low or high.

It’s essential to read your insurance policy and understand the insurance product you bought.

The Disadvantage of Mortgage Level Term Assurance (MLTA)

Expensive.

The downside about Mortgage Level Term Assurance (MLTA) is it’s slightly expensive compared to Mortgage Reducing Term Assurance ( MRTA ). However, If you pay promptly until the end of tenure, you might get back whatever you have paid or even up to 80-90% of what you have paid.

MLTA is a better product compared to MRTA in terms of coverage and surrender value. But it doesn’t come cheap.

There is a saying.

“Cheap things are not good; good things are not cheap.”

For the same client,

- age 40

- Female

- the sum assured of RM300,000

- Coverage 30 years

The MLTA Premium is about RM4404 per annum or RM367 per month.

For 30 years, MLTA is RM132,120, and MRTA is RM18,841.

Even though MLTA is a more superior product, but because of the price, some people stay away from it.

But, sometimes people forget that the amount RM132,120 will not be burned like MRTA RM18,841.

RM132,120 can consider as a future saving or an investment where you will get it back in the future (after 15 years). If not 100%, maybe 80-90% of all your premium paid.

My Personal View

By the end of the day, both Mortgage Reducing Term Assurance ( MRTA ) and Mortgage Level Term Assurance (MLTA) is both a good product. Both products have advantages and disadvantages.

For me, I like MLTA. It’s the right product for me. Even though it’s expensive, I think everyone should at least buy one.

It’s a saving, protection towards our liabilities, and it also a type of investment for our future.

But, it might not right for everyone. If you have the cash, at least get it and keep one by your side.

It doesn’t matter whether, Mortgage Reducing Term Assurance ( MRTA )or Mortgage Level Term Assurance (MLTA), choose a product that suits you the most.

If you need MLTA Quotation, feel free to reach us at 012-6946746.

LIKE, SHARE & FOLLOW US!

#malaysiahousingloan

Online Mortgage Consultant

Call or Whatsapp Us: 012-6946746

Visit Our Website: Www.MalaysiaHousingLoan.net

Subscribe Our Youtube Channel: https://www.youtube.com/malaysiahousingloan

Follow us on Facebook: https://www.facebook.com/malaysiahousingloan/

Leave A Comment